Artificial organs become a reality

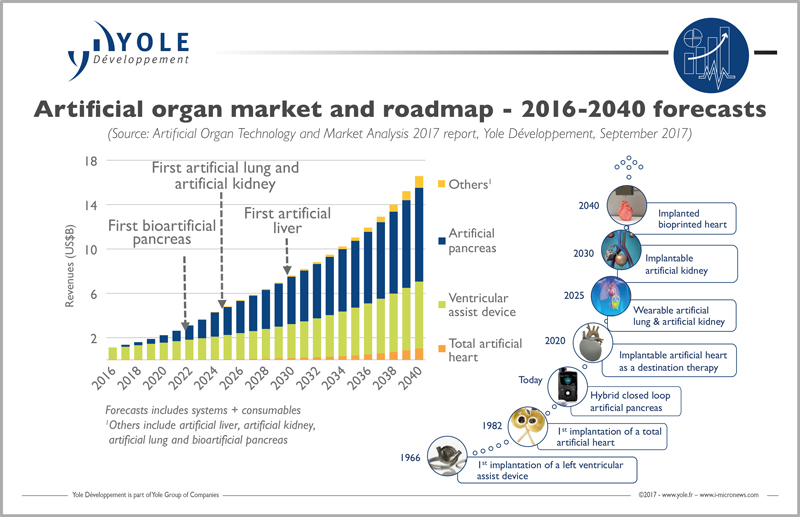

After decades of development, artificial organ products are now ready to enter the medical device market. Innovation will solve time, and the problem of shortage of human organ donors. The artificial organ market will be worth $1.3bn in 2017 and its 20% CAGR over the next five years will see it grow to $3.5bn in 2022.

“This impressive growth is mainly driven by the exceptional growth of the artificial pancreas segment, showing a 49% CAGR between 2017 and 2022 in value”, commented Dr. Marjorie Villien, Technology & Market Analyst at Yole Développement. “The ventricular assist device market is mature and showing a 9% CAGR during this period. From its side, the total artificial heart market is still emerging. Its CAGR reaches 15% between 2017 and 2022”.

The market research and strategy consulting company, Yole Développement (Yole) is positioned to provide a deep understanding of this revolution with a new technology and market analysis titled 'Artificial Organ Technology & market analysis'.

What are the main technical challenges and market issues? How can artificial organs companies overcome them? What do end-users expect? How will the healthcare industry be impacted? How will the regulatory landscape evolve?... Yole’s MedTech team offers you today a snapshot of the artificial organs market.

Organ transplantation is often the only treatment for end-state organ failure, such as liver, kidney and heart failure. Tragically, most people on the waiting list die before they ever get an organ.

Hence, the dream of developing artificial organs made of electronic and mechanical parts has been around for decades. The first total artificial heart transplant was in the 1980s, yet since then few improvements have made these devices more efficient.

Newcomers such as Carmat and Bivacor are aiming to change the paradigm from a single mechanical heart towards a smarter solution, with embedded sensors and intelligence.

“Artificial organs made of electronics, intelligence and mechanics are the first steps”, explained Dr. Marjorie Villien from Yole. “The next logical steps are to build organs using biological tissues, but the first bioprinted heart will probably not be implanted before 2040.”

The next wave of development came from the diabetes epidemic that affects every country, hitting more than 8% of the global population today. The artificial pancreas market will therefore experience a huge 49% CAGR over the next five years: the next breakthrough to happen will come in five to ten years, bringing artificial lungs and kidneys.

The first commercially approved devices will be wearable systems such as the Wearable Artificial Kidney Foundation, Inc. (WAKFI) system. Soon after the first wearable kidney, we should be able see a leap to an implantable device like that developed by the kidney project at University of California, San Francisco and Vanderbilt University.

Artificial organs combine many advantages besides availability, including fewer compatibility issues, eliminating ethical concerns around organ trafficking, and decreasing cost.

“Bringing a new artificial organ to market is a very long and costly project,” commented Asma Siari, Technology & Market Analyst from Yole.

The average time of development for such a complex technology is about 15-25 years in addition to the five to ten years of testing and regulatory approval. These gigantic delays explain why few companies have ever invested in artificial organs, even if the total available market is humungous. Investors have to be patient and developers determined to bring such a technology to market.

Ventricular assist devices form an established market, with big players such as Abbott and Medtronic, who respectively bought the two leaders of the field Thoratec and HeartWare.The total artificial heart is still an emerging market, since the only player has been Syncardia for years. With the arrival of newcomers, the total artificial heart market will experience substantial growth with a 15% CAGR between 2017 and 2022.

Yole expects penetration of the artificial pancreas to be also very high and fast in the type 1 diabetic population, since the community has wanted this solution for years. Only Medtronic had an artificial pancreas system approved by the FDA in 2017 and none has a European CE mark.

However, many companies are ready for approval and commercialisation, especially two collaborations: one between Diabeloop, Dexcom and Cellnovo; and one involving TypeZero, Dexcom and Tandem.